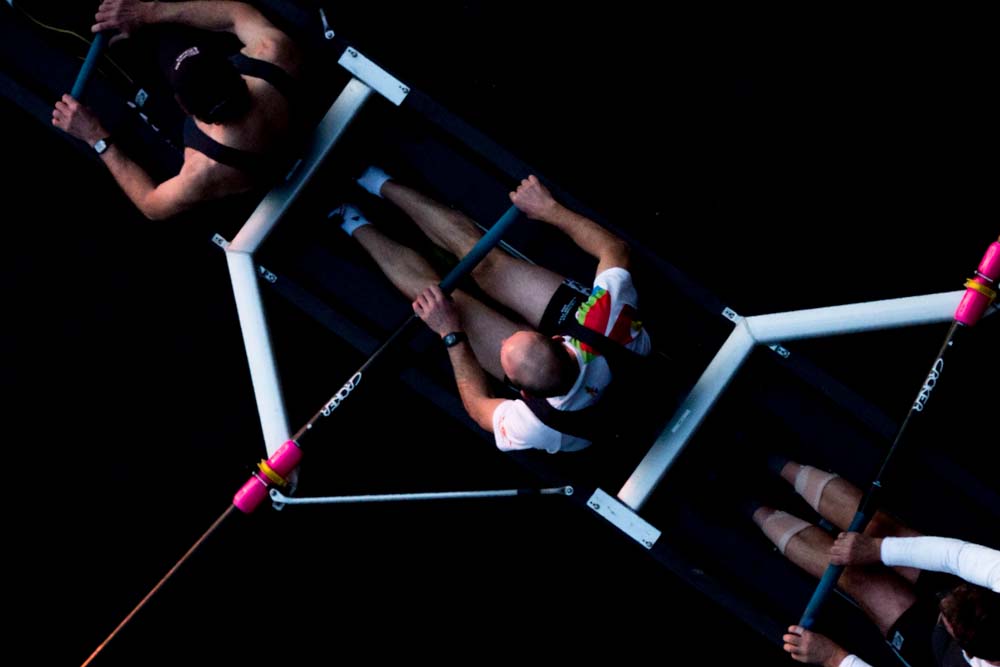

We’re specialists in arranging life insurance for active sports and hazardous occupations

Having been a market-leading hazardous occupations and sports insurance provider for more than two decades, it is important to maintain focus and drive in the face of an ever-changing market that demands the utmost attention and professionalism. This is especially true of the Extreme Sports and Dangerous Occupations insurance market, where the rapid development and diversification of sports and jobs for which cover is key, has been a source of enormous expansion in the past few years.

With a deep understanding of the unique risks involved in activities like skydiving, mountain climbing, and white-water rafting, we tailor our insurance packages to ensure all athletes and hobbyists are adequately protected. Our team of experts works closely with clients to assess their individual needs, crafting policies that offer extensive coverage for potential accidents, injuries, and liabilities inherent in these adrenaline-fueled pursuits. Whether it’s safeguarding against medical expenses or liability claims, Sports Financial Services is dedicated to providing peace of mind so that you can pursue your passion with confidence.

We also recognise that traditional insurance policies often fall short in addressing the specific challenges faced by those who have hazardous jobs or participate in extreme sports. That’s why we go above and beyond to offer the best insurance solutions tailored to the needs of thrill-seekers. Our policies not only provide financial protection in the event of accidents or injuries but also offer comprehensive cover via critical illness cover, or mortgage protection. With Sports Financial Services, regardless of your hobby or occupation, you deserve to know you have an insurance partner with your best interests at heart.

We deal individually with you and are able to quote a premium that takes into account your unique sporting activities before the submission of an application to underwriting.

Get Started 0345 565 0935

Discuss cover for over 100 sports

Next working day call back

Founded over 25 years ago

Why Life Insurance and Financial Protection Matter

Engaging in hazardous sports comes with an undeniable thrill—the adrenaline rush, the sense of achievement, and the sheer excitement of pushing your limits. But along with the rewards come risks that require careful planning. Whether you’re a skydiver, rock climber, motorsport racer, or deep-sea diver, ensuring financial protection for yourself and your loved ones is essential.

Life Insurance: Providing for Your Loved Ones

Life insurance is the cornerstone of financial security for extreme sports participants. If the worst were to happen, life insurance could ensure that your dependents receive a financial payout, easing the burden during an emotionally challenging time. Knowing that your family will have financial stability even in your absence can offer invaluable peace of mind.

Mortgage Protection: Safeguarding Your Home

Your home is likely one of your biggest assets, and protecting it should be a priority. It is important to consider how you and your family would meet mortgage payments in the event of serious illness, injury, or death. Whether you’re conquering mountain peaks or taking on high-speed racing circuits, having mortgage protection prevents your loved ones from facing financial uncertainty should you no longer be able to make payments.

Income Protection: Maintaining Financial Stability

Hazardous sports can lead to injuries that may temporarily or permanently hinder your ability to work. Income protection insurance is designed to provide a steady stream of income for a period of time if you’re unable to earn due to illness or injury. This ensures you can continue to meet financial obligations while focusing on recovery, without the stress of lost wages.

Critical Illness Cover: Shielding Against the Unexpected

Extreme sports come with an increased risk of serious injuries and critical illnesses. Critical illness cover provides a payment upon diagnosis of a covered condition, helping to manage medical expenses, rehabilitation, and lifestyle adjustments. This type of protection ensures you have financial support to navigate life-changing circumstances.

Take Action Today

The thrill of hazardous sports shouldn’t come at the cost of financial insecurity. By investing in life insurance, mortgage protection, income protection, and critical illness cover, you can confidently pursue your passions knowing that your future and your family’s well-being are safeguarded. Don’t wait—ensure your peace of mind today and continue living life to the fullest with the protection you deserve.

as the leading provider of financial protection for those engaged in outdoor activities.